Receiving an IRS notice can be a scary moment for many taxpayers.

What can you do? Where should you go for information? There are often

many unanswered questions when you open your mailbox to find a notice.

First, you need to find out what the notice is regarding. The IRS

sends notices out for many different things, such as requesting a tax

payment, requesting additional information, or notifying you if changes

to your account. Read through your notice very carefully, and if you are

not 100% clear on what the notice is about, seek professional guidance

from a licensed CPA or tax preparer.

If the notice you received is letting you know that the IRS has made a

change to your tax return, be sure to review the information very

carefully, and compare it to your tax return on file. If you agree with

the changes made, then usually there is nothing further that you need to

do. If you disagree with the changes made, be sure to respond to the

IRS in writing, stating what your disagreements are. The IRS can take up

to 30 days to respond, so try to be patient.

If your notice is requesting a payment, you have a few options. If

you have the means to pay the full amount due, this is always the best

option. If paying the full balance is not a feasible option, setting up a

payment plan in an option. In addition to setting up payment plans, the

IRS also gives the option of settling the debt for a smaller amount to

qualifying taxpayers. Even if you do not have the money to pay for the

amount requested, do not ignore these notices. The IRS will be much more

understanding if there is communication between parties and a

willingness to work diligently to have your debt settled.

If your notice is requesting additional information from you, provide

that information to the best of your ability. If you have a complicated

tax return, and do not have a licensed tax prepares or CPA, you may

want to contact one to ensure the correct information is provided.

Further misunderstandings can create a much more drawn out process.

No matter what your notice is about, you will want to make sure to

keep a copy of the notice on file, as well as any further correspondence

with the IRS. This will be helpful if there are any disagreements

between yourself and the IRS during your contact with them.

Your IRS notice will have a phone number in the top right corner.

This is a great resource, and usually the best way to contact the IRS

regarding questions about your notice. Going into an IRS office is

usually not necessary to get your situation resolved. Stay calm, and

keep very good records of your tax related information and documents,

and you can get your tax matter resolved with the least amount of stress

possible.

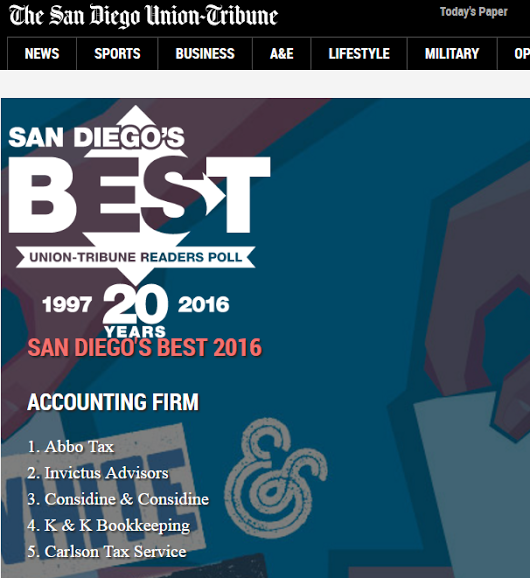

If you received an IRS notice and need assistance, visit Abbo Tax CPA in San Diego.

No comments:

Post a Comment